Get the AvaTradeGo App Now

One Cancels the Other Orders

Ultimately, regardless of the price movement, only one order can be executed or remain active in the market at any given time. Trade automation is vital for success in the markets. This is what an OCO achieves. It essentially eliminates emotions from trading activity and promotes systematic trading by ensuring triggered entering of trades. A trader sets the parameters to be met before a trade is entered. If the conditions are met, the trade is entered; if not, the alternative trade, usually in the opposite direction, is triggered. This effectively removes human subjectivity in trading and enhances objectivity. An OCO is also used as a risk management tool, ensuring that traders minimize negative exposure to the markets, while simultaneously enhancing their potential profitability.

The importance as a risk management tool is often something that is overlooked; however, it is a prerequisite to the success of your trading career. Planning ahead and knowing what risk management tools to implement is the essence of managing your trading portfolio. Do not fall into the trap of entering your trades blindly or with a gambling attitude: you may enter one or two lucky strikes; however, emotions begin to dictate your trades and eventually this will cause you to endure painful losses. There are endless benefits for investors when using the OCO orders as a risk management tool. For instance, when markets are experiencing price gaps as well as sharp price movements that occur in an unplanned trading environment, a trader may fail to open a position on one predefined level. Pre-setting the OCO order will be your solution to these occasions.

Open your trading account at AvaTrade or experiment with different orders on our risk-free demo account!

How to use One Cancels the Other?

Setting One Cancels the Other Order

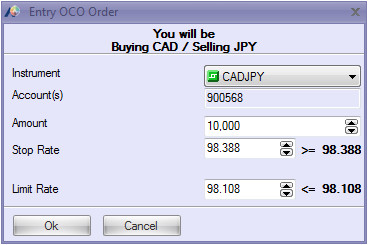

Locate the desired instrument, settle on buy or sell. Right-click the instrument and choose Entry OCO.

Set your preferences on the Entry OCO Order window.

Setting One Cancels the Other Order on an existing Entry Order

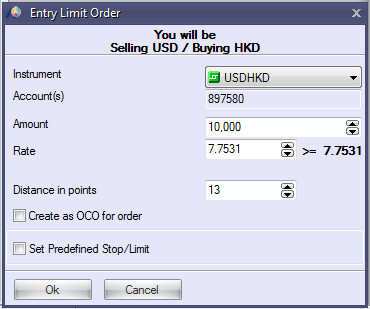

In order to set an OCO order, first open an entry order. This will appear in the order windows in your platform.

![]()

Once the first order appears, while hovering above the row with your order, right-click with the mouse and choose the OCO Link option. Then choose Set to New Order.

The new window that will appear, offering you to make the opposite entry order to the existing one (i.e., entry limit sell, will have an OCO order of entry stop sell)

![]()

Once the second entry order is set, the order window will show both orders, including the number of the other order.

Open a trading account now or practice setting various orders on our advanced trading platforms on a free demo account.

One Cancels the Other FAQ

- Why would I want to use a one cancels the other order?

One cancels the other orders are often used by experienced traders who want to limit their market risk when entering a position. They can be particularly useful when trading breakouts or retracements because of their risk management feature. For example, if a trader was looking to place a trade when price breaks above resistance or below support, they might use a one cancels the other order. They would do this by placing a buy stop and a sell stop, and if one triggers the other is immediately cancelled. This can also be very useful around earnings releases, when a trader is sure price will move substantially, but they aren’t sure in which direction.

- What is another name for a one cancels the other order?

Because the one cancels the other order is often used to trade breakouts or tight trading ranges it is also called a bracket order. That’s because it brackets the current price in anticipation of a move in one direction or the other. This can be useful for a trader who is sure price is going to move substantially in one direction or the other, but not sure when this will happen or in which direction price will move. Often earnings releases are a good time to use this type of order. They can also be used when consolidation patterns appear.

- What’s the best time to use a one cancels the other order?

Traders may use a one cancels the other order when anticipating a significant move in either direction, but they are unsure which direction that will be. This often occurs with volatile stocks after earnings reports or new product releases. The one cancels the other order can also be useful during periods of consolidation in stocks when they are trading sideways in a tight range. The same rationale prevails. The trader knows that the stock will be breaking in one direction or the other, but is unsure which direction price will take.